I’ve drafted a couple different posts about my February spending, but I keep getting stuck.

February wasn’t just about numbers. It was about more than the fact that I paid $1,811.35 to debt. It was about more than the fact that I didn’t buy any clothing or impulsive non-consumable purchases. (I still want a french press, but I’m being patient.)

February was an emotional shift for me with this whole debt freedom journey I have been on.

September 4, 2017, was when I decided to commit to this. I had a twisted up relationship with money ever since I can remember. I was a spender. I got sick just thinking about logging into my checking account. I felt like I had zero control, had an apartment full of shit I didn’t really care about, and so many debt payments I usually forgot about one of them when I was paying my bills each month.

So I had to go all out. I needed tough love. Dave Ramsey and what he teaches was the hardass approach I needed. Don’t hold me and tell me it will be okay, grab me by the shoulders and tell me to get my head out of my ass. I had taken charge of my life in so many other ways, and it was time to take control of my finances.

I’ve had that hardass mindset ever since then. I knew it would be a grind, and not just a marathon but an ultramarathon in the patience and consistency department. This entire time I have kept my head down, said no to a lot of things, and kept chipping away at my total debt number (which was $40,611 when I started).

And then February came. Two significant things happened.

1 – I surpassed the halfway mark finally! I knew that I was on pace to make my LAST credit card payment in March, and then it would just be my car loan!

I have carried shame about credit card debt for a lot of years, and it wasn’t until I started this journey and decided to share the details of what I was doing that the shame melted away… but there is still emotion tied to it.

On Friday, March 8th I will make my LAST credit card payment.

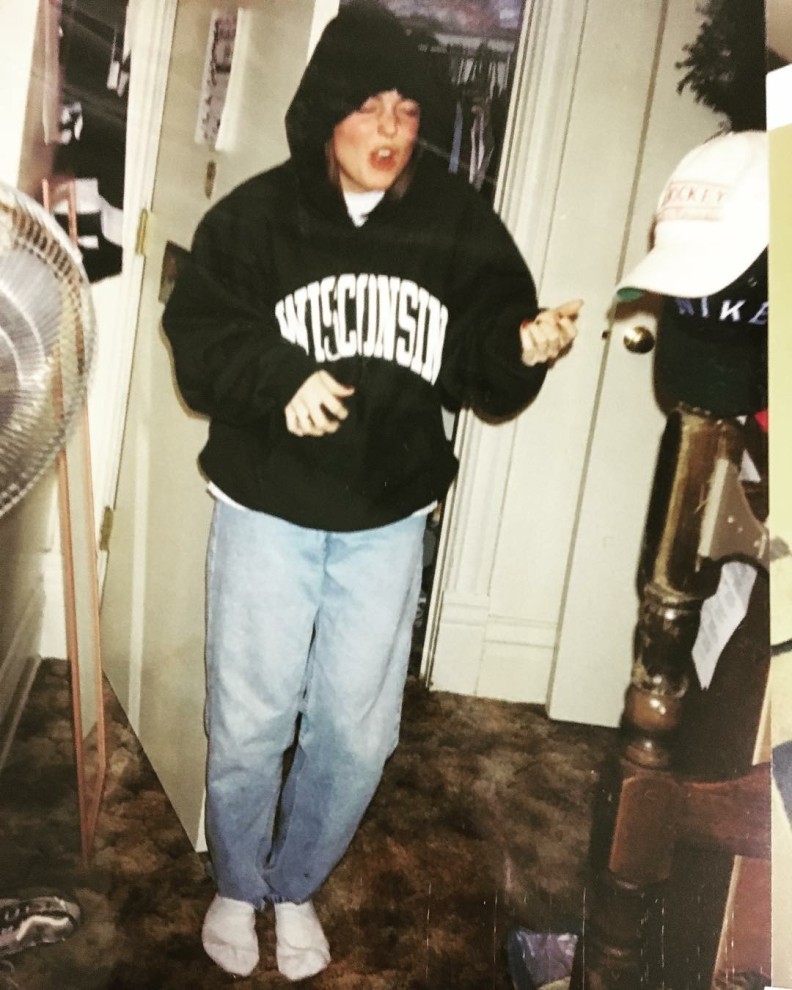

The last time I was credit card debt free was February of 2011. And it lasted four days. FOUR DAYS. I decided to treat myself and charge a new snowboarding jacket, matching gloves and a hat.

2 – I found out that I’m getting a bonus in March. And not just any bonus, but the biggest one of my adult life. When I set my goal of paying off all my debt by Halloween of this year, I wasn’t factoring in a bonus. I was hoping, but definitely not banking on it.

Now not only am I paying off my credit card debt in March, but I’ll be paying down a sizeable chunk of my car loan, and I’ll be debt free by July or August of this year!!

There is a surprising amount of emotion in that for me. I never let myself look forward to a light at the end of the tunnel of this process, but it’s coming. In just a few months I will be able to pay off my car three years early and know that I have persevered, and am 100% debt free.

The girl who regularly defaulted on her credit card in college, had a credit score in the 400’s, bounced checks like it was her job in her early 20’s has finally turned things around.

Identity is a tricky thing. I have had years of telling myself that I am bad with money, that there would never be enough, that I would never be comfortable, and now I am faced with telling myself a different story. And the root of the change was realizing that I was ultimately in control of my behavior – I just had to decide to do things differently.

And I have been doing things very differently since September 4, 2017. I was talking with Spencer tonight about this and how emotional this process has become now that I’m entering the home stretch. He asked me if I was afraid of reverting back to my old money habits.

I don’t think I am. The emotional piece is that I am finally seeing that I am not the person I thought I was for years and years. Maybe I am not a fuck up. Maybe I can consistently make good choices with money to create a better future for me, and even for my partner. Maybe the impulsivity and drive to satisfy my wants don’t have to win in the end.

Maybe taking charge of this bad behavior of mine is the turning point for the trajectory of the rest of my life.

Financial tip of the week –

Listen to podcasts!! I listened to these two episodes by Death, Sex and Money while working out tonight and they are amazing. Student loan debt and the stress associated with it is real, and if you feel buried and alone in your student loan debt, listen to these, Seriously. It will help.

As always, I gotta give a recap of the numbers for last month.

Debt number on February 1: $21,188.40

Total paid to principal in February: $1,811.35

Debt number on February 28: $19,377.05

The hardest thing I said no to this month: I had a back flare up for a couple weeks and really wanted a massage. Instead, I stretched more and spent more time on the foam roller to work it out!

Total amount of debt paid since I started this journey: $21,233.95

Any interest in a Thermos 34-Ounce Vacuum Insulated Stainless-Steel Gourmet Coffee Press? I have one that I literally never use. Marie Kondo would be happy if I got rid of it. Also, have you heard of the “Buy Nothing Project”? A few in Madison, but not in my neighborhood. Keep up the blog I love reading it.

LikeLiked by 1 person

Hi Rachael! My lovely mom actually bought me a French press for my birthday that is on the way! I appreciate your offer though. If t doesn’t spark joy for you I’m sure it will for someone else! :). And I haven’t heard of the Buy Nothing project – I’ll check it out! Looking forward to seeing you next time I’m in Madison!

LikeLike